Original Thread on Twitter here.

The most valuable technology companies all have one thing in common: Aperture.

An aperture is an opening. For investors, aperture is synonymous with opportunity: what aperture exists for a company to access new products & revenue lines?

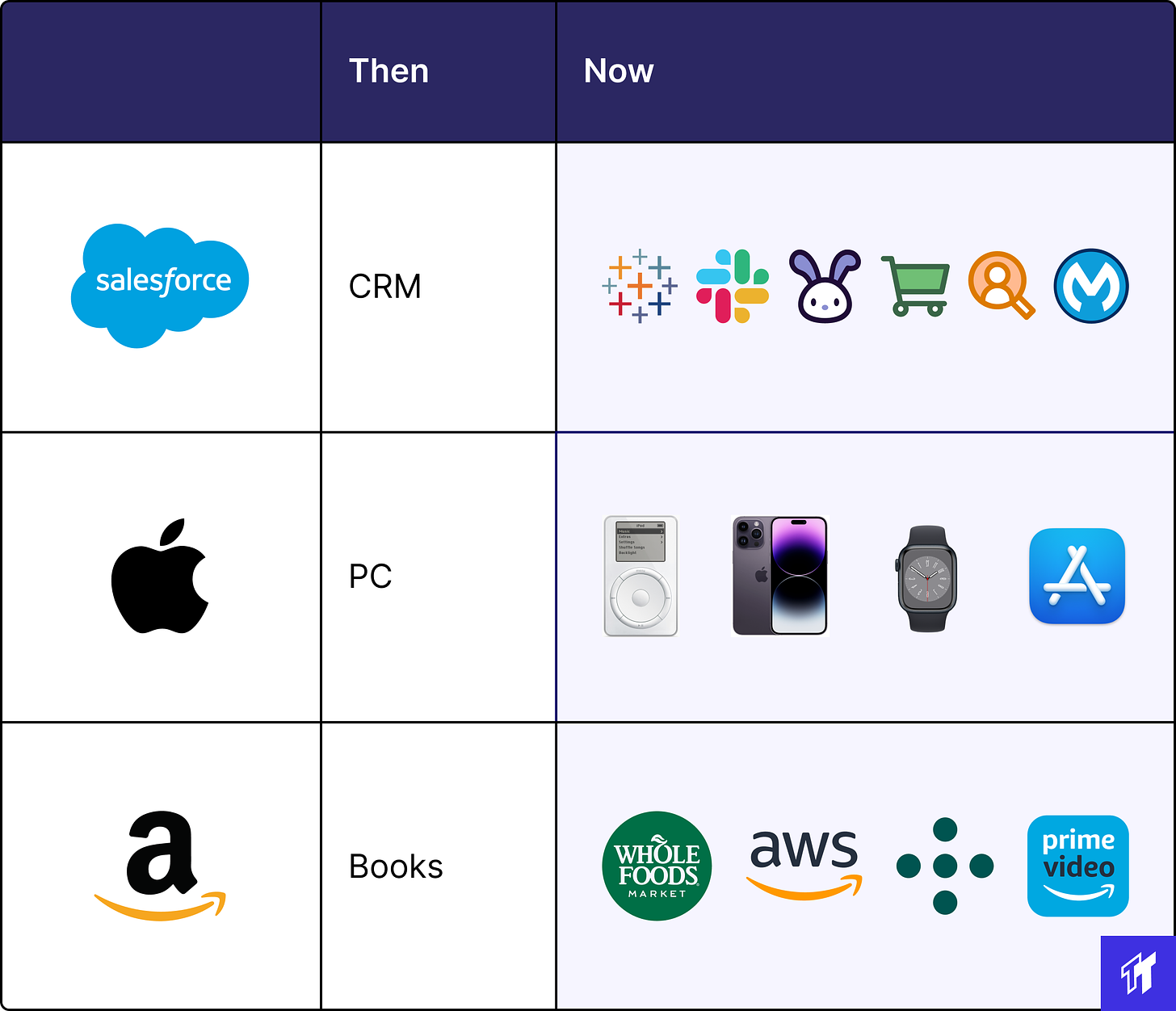

Enduring companies all have a history of capitalizing on and expanding aperture:

Salesforce began as just a cloud CRM, then accessed apertures well beyond sales with marketing, finance, and commerce clouds – and acquisitions of Tableau, Slack, and Mulesoft.

Photo by Adrian Trinkaus on Unsplash

Apple was a PC company before expanding its scope in the 2000s with the iPod, and then iPhone – which laid the foundation for an ecosystem: watch, iPad, AirPods, fitness, and the exceptionally profitable App Store.

Amazon is perhaps the most ambitious instance of aperture.

Originally just an online bookstore, Amazon then began selling everything* online and layering products into its consumer bundle: video, music, grocery (Whole Foods), healthcare (OneMedical, Pillpack)...

Amazon also attacked an aperture in infrastructure computing with AWS, a seemingly off-focus product that now accounts for an estimated 50%+ of enterprise value.

These expansion examples underscore a flywheel: accessing apertures leads to more future apertures. Because:

Companies build the muscle for launching new products successfully

New products inherently unlock new adjacencies & opportunities

The iPhone is an example of this: Apple may not have foreseen, let alone had the capability to design & manufacture the product, if not for the prior invention of the iPod.

This is why winners win big in tech: the more products you launch successfully, the more that follow.

Whether you’re an entrepreneur, product leader, or investor, the question to ask is: where’s our aperture?

What do we need to build next?

And then next after that… point solutions beware (:

More on aperture next Thursday.