Originally published on Twitter and Linkedin on 01/19/2023

The fix is in -- and it looks worse than 2008. Five reasons a recession feels inevitable. Thursday Thread, co-written by Ben Kany ...

Recessions revolve around [a] How much $ consumers feel they have & [b] How much things cost. This is effectively two sides of the same coin. Five indicators that point to a looming recession:

1/ Inflation

2/ Interest rates

3/ Wage growth

4/ Savings rate

5/ Consumer sentiment

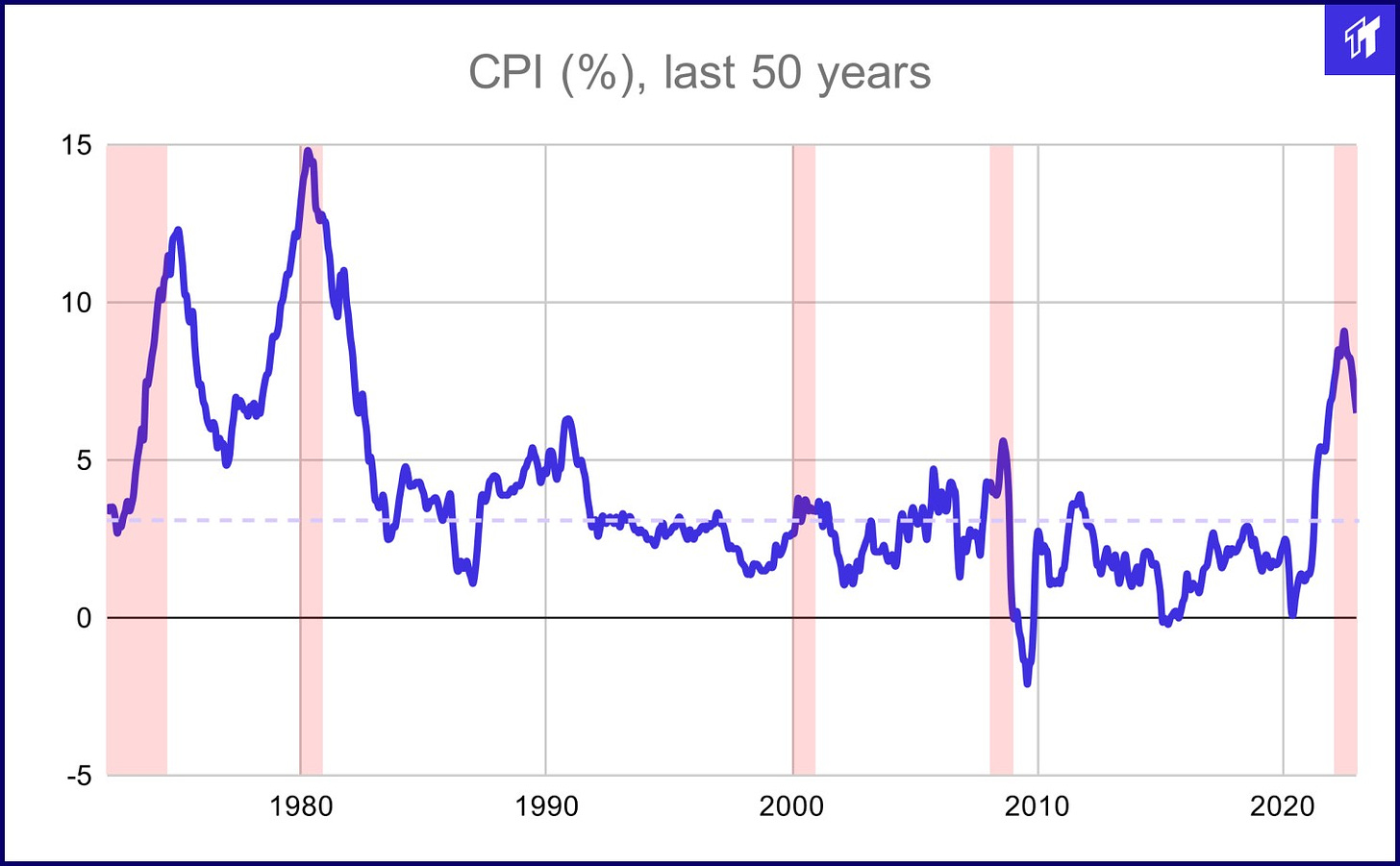

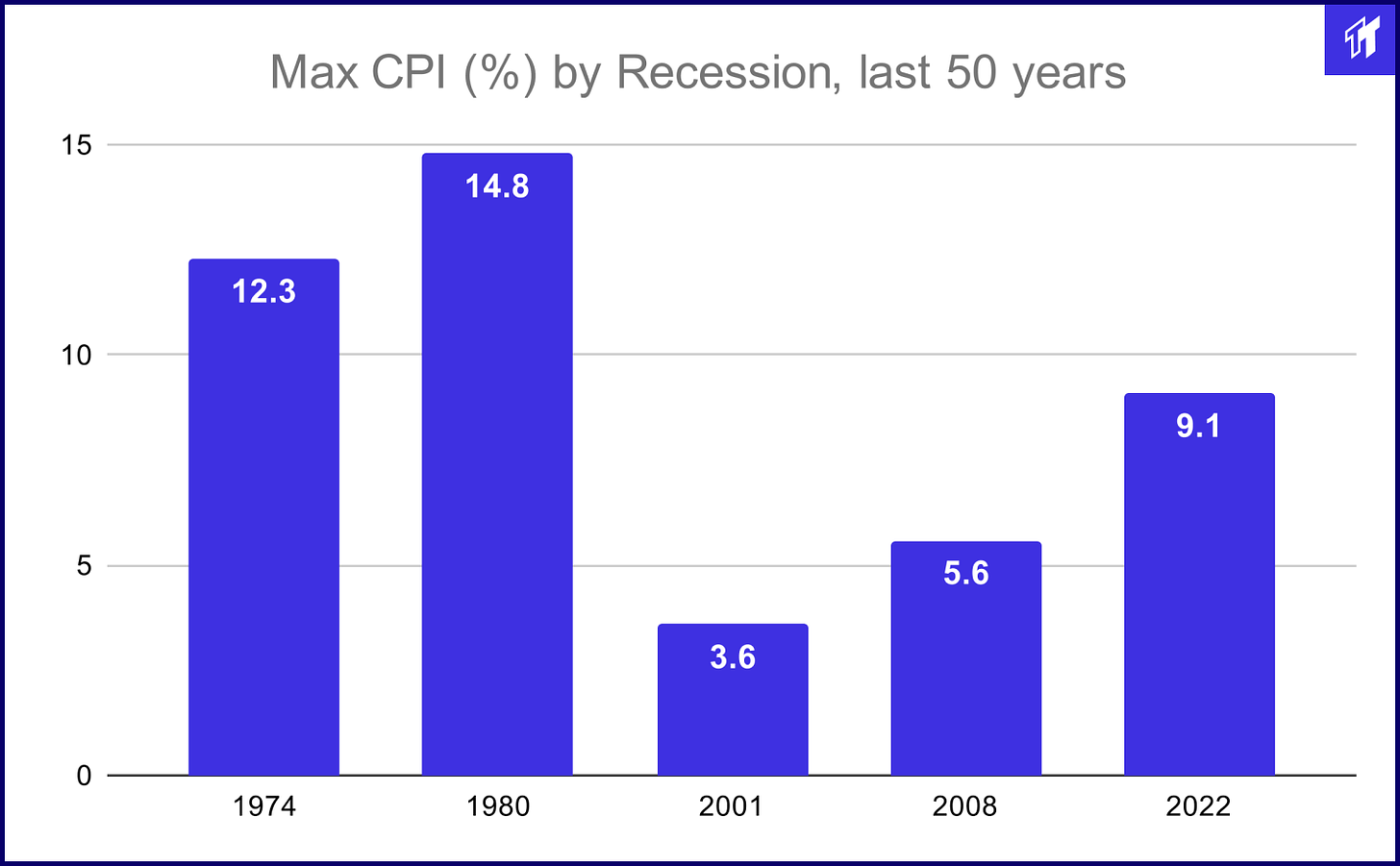

#1 Inflation: the rate at which prices for goods & services rise, and subsequently, purchasing power falls. The leading measure is the Consumer Price Index (CPI), which is released monthly.

CPI is far from perfect: it doesn’t capture all production/consumption and doesn’t reflect changes in living standards or good/service quality. But it’s the best metric we’ve got.

Over the past 100 years, it averaged under 3%

In 2022, CPI averaged 8%+

Last year, CPI reached a 40-year high in June: 9.1%

CPI peaked at just 5.6% during the Great Recession 😬

This has many downstream implications, most notably on interest rates…

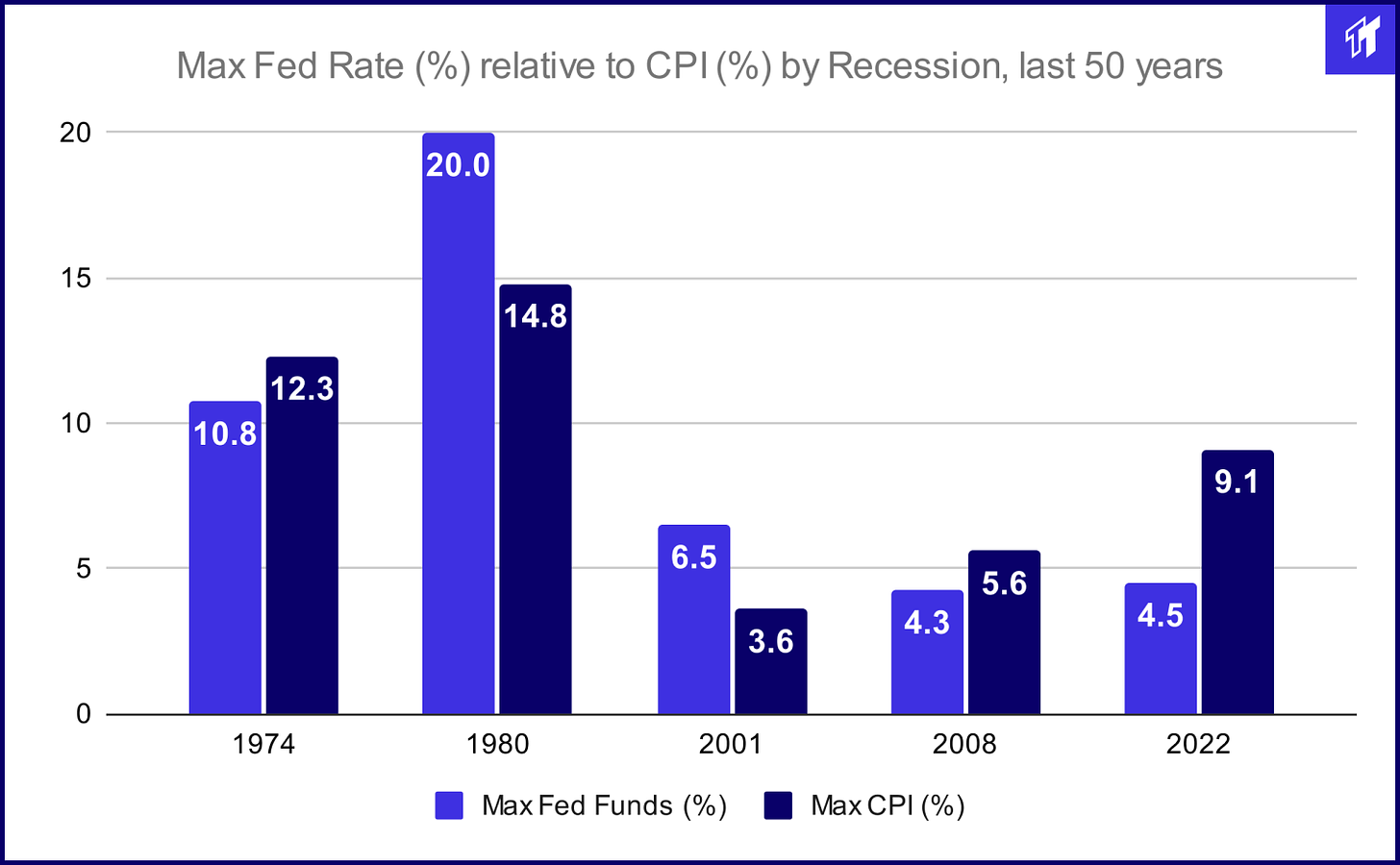

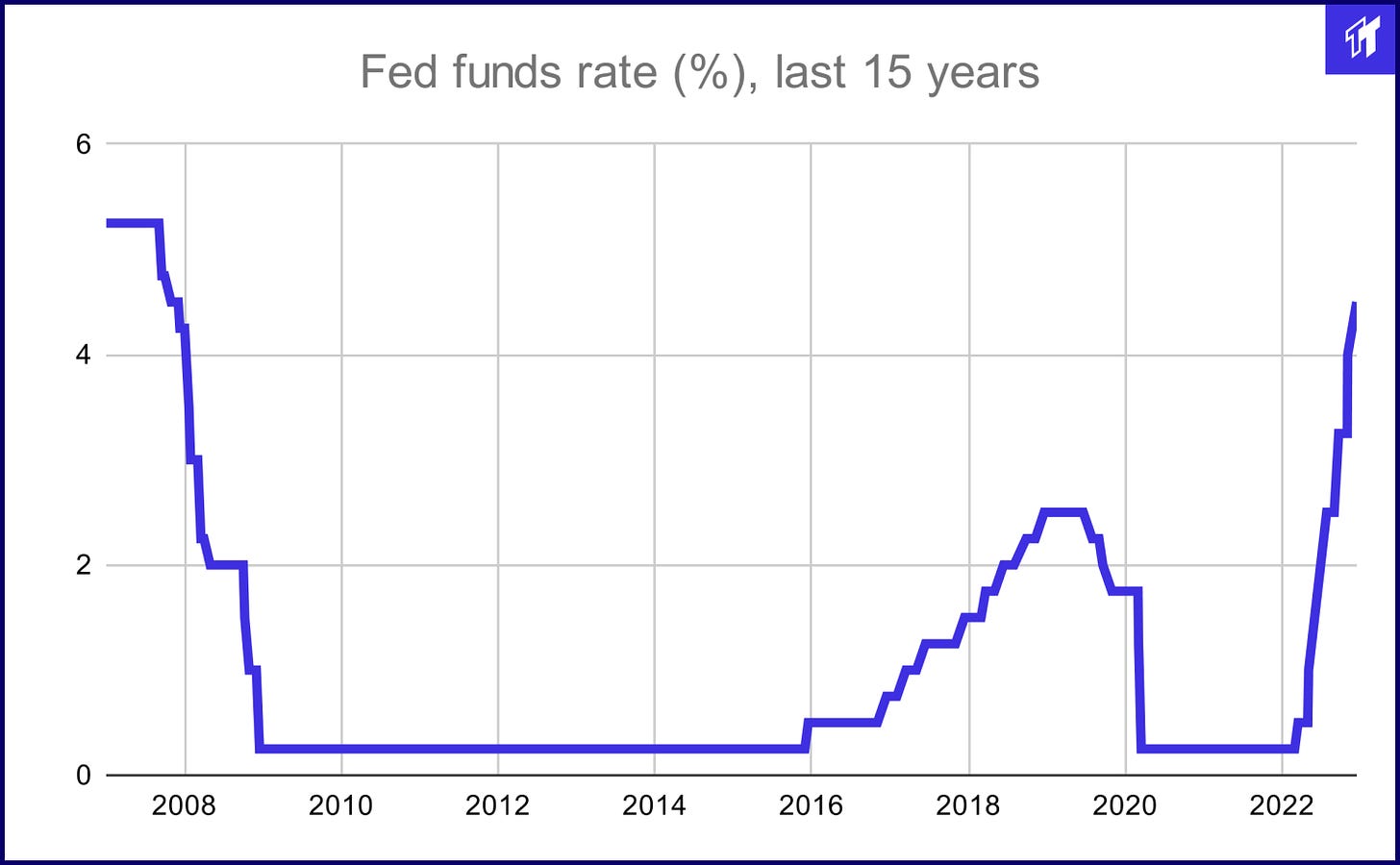

#2 Interest rates. The Fed rate is the rate at which banks lend money to each other. It’s a powerful tool that influences the economy:

Higher rates slow borrowing & spending to combat inflation.

Lower rates incite borrowing & spending, and inflation.

Last year, in response to inflation, the Fed raised rates at a dramatic pace, with seven hikes to a ~4.5% fed funds rate today. But there's a long way still to go – last time CPI was this high (1981) then-Fed-Chair Paul Volcker raised the rate to 20% (!!)

Volcker oversaw a much stronger US balance sheet, however. Under the current national debt, 10%+ rates are not happening, given the implied debt service.

Nevertheless, rates will continue to rise from an already 15-year high:

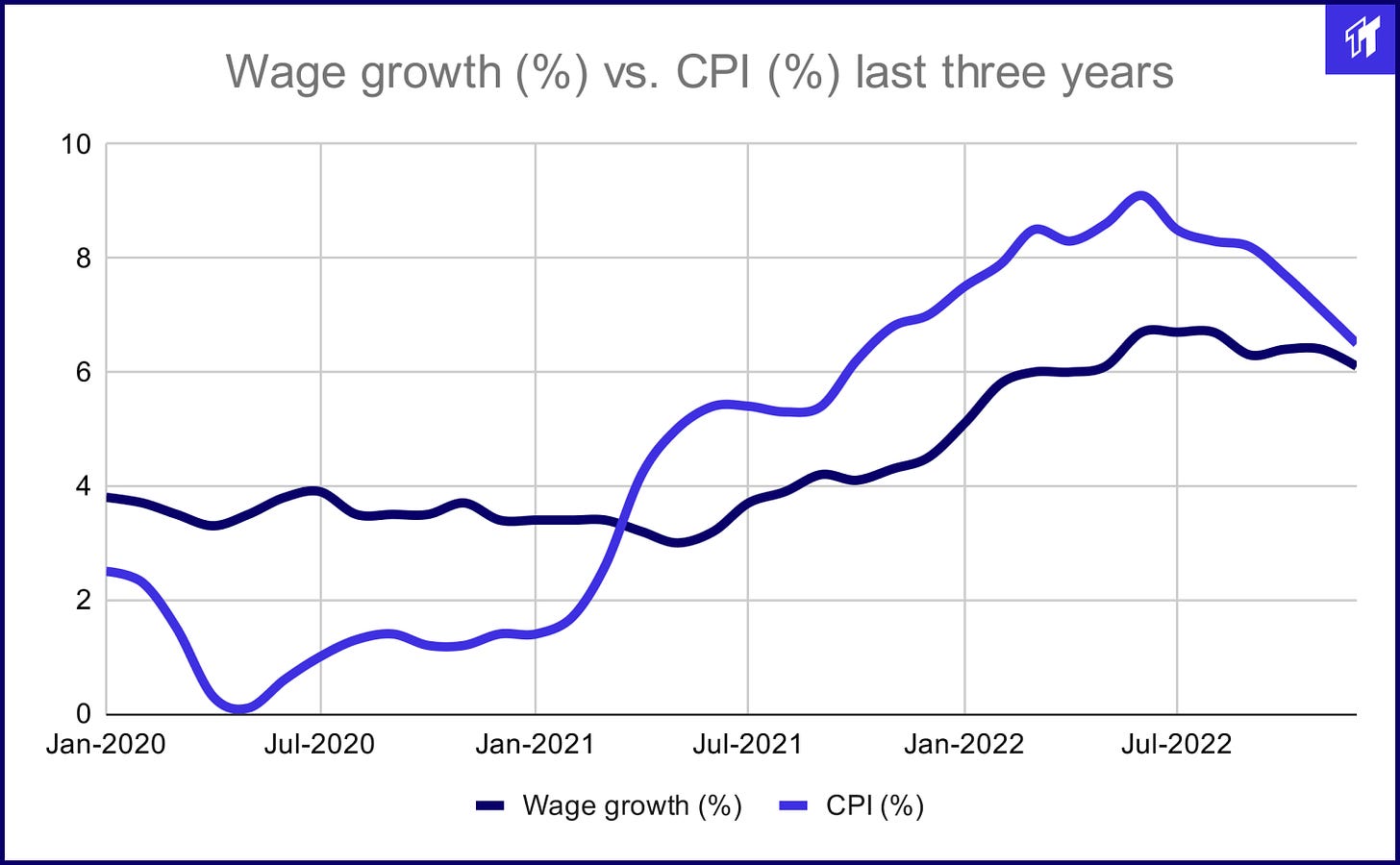

#3 Wage growth. As interest rates rise, credit tightens. Accordingly, businesses cut costs: unemployment rises, and wages fall.

Unemployment has been surprisingly resilient (topic for a different Thursday 😉)

Inflation, however, has outpaced wages for two years:

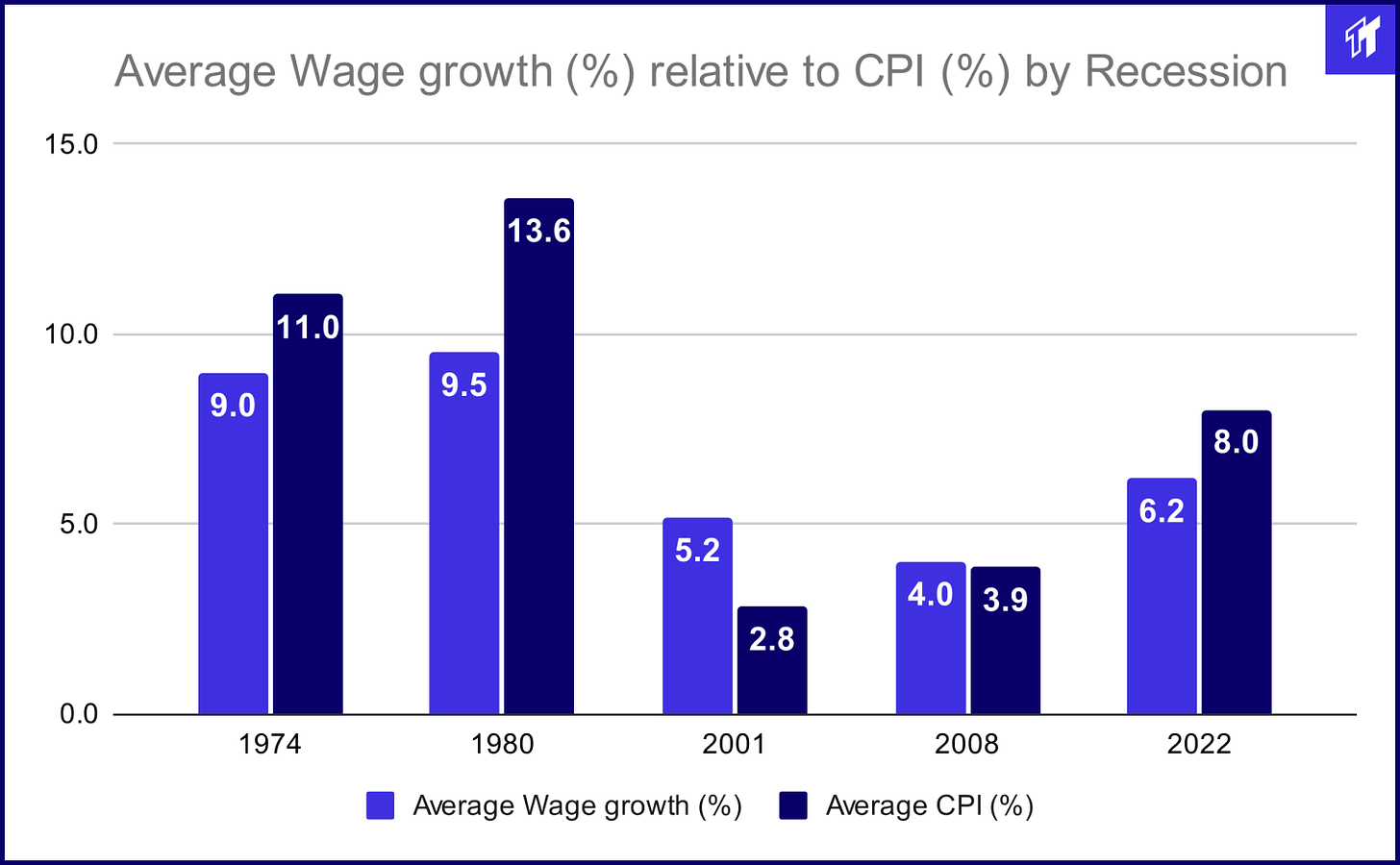

This flippening implies a hard hit on the consumer wallet. And it's more severe than any recession since 1980:

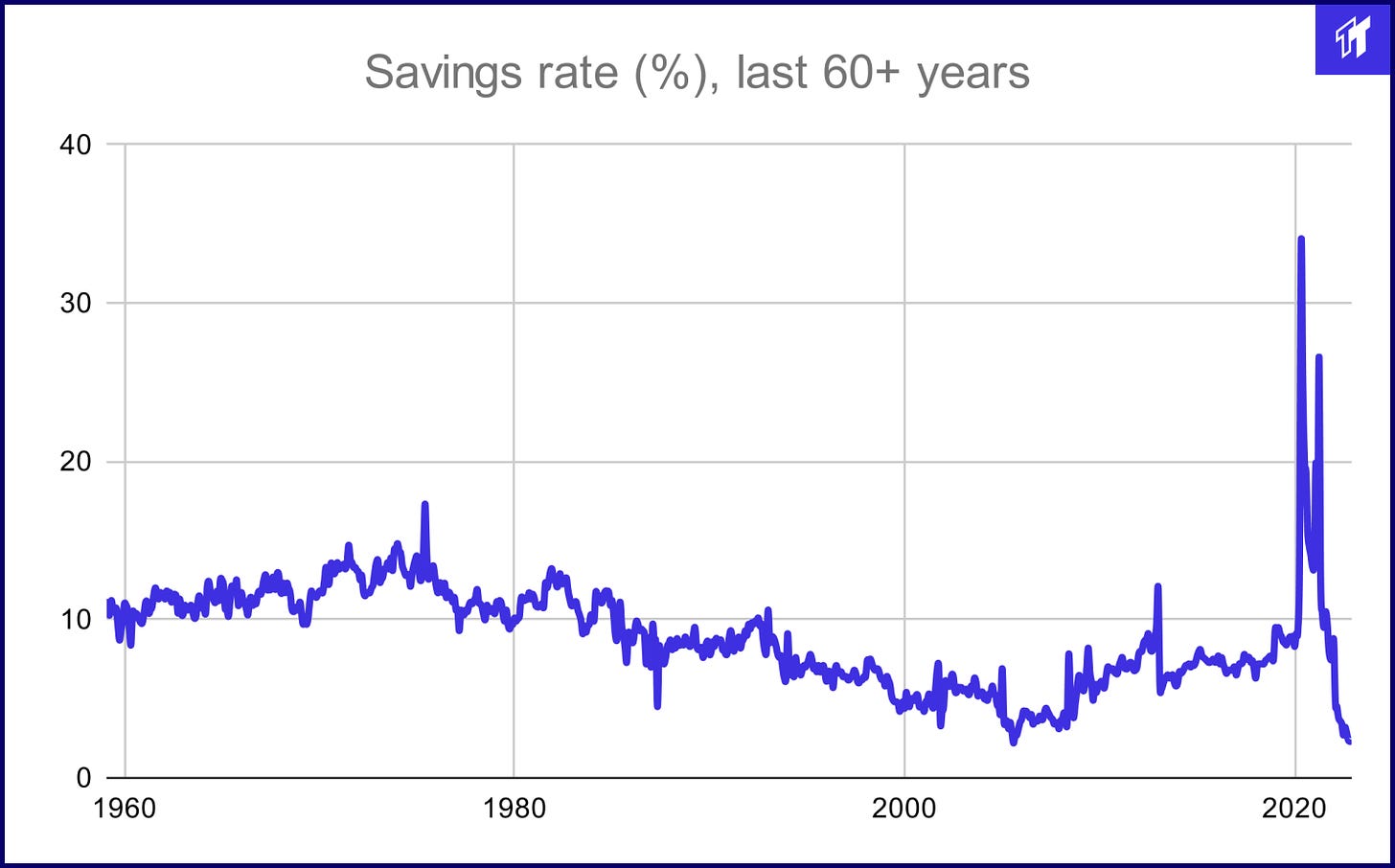

#4 Savings rate: the percentage of disposable income households save. When inflation outstrips wage growth, consumer savings fall, and the economy is vulnerable.

In 2022, savings hit a ~20 year low at 2.3%

This leads to the final and (imo) most important indicator: #5 Consumer sentiment.

Recessions are caused by the collective actions of many – sentiment is foundational.

You feel scared = I feel scared = we feel scared

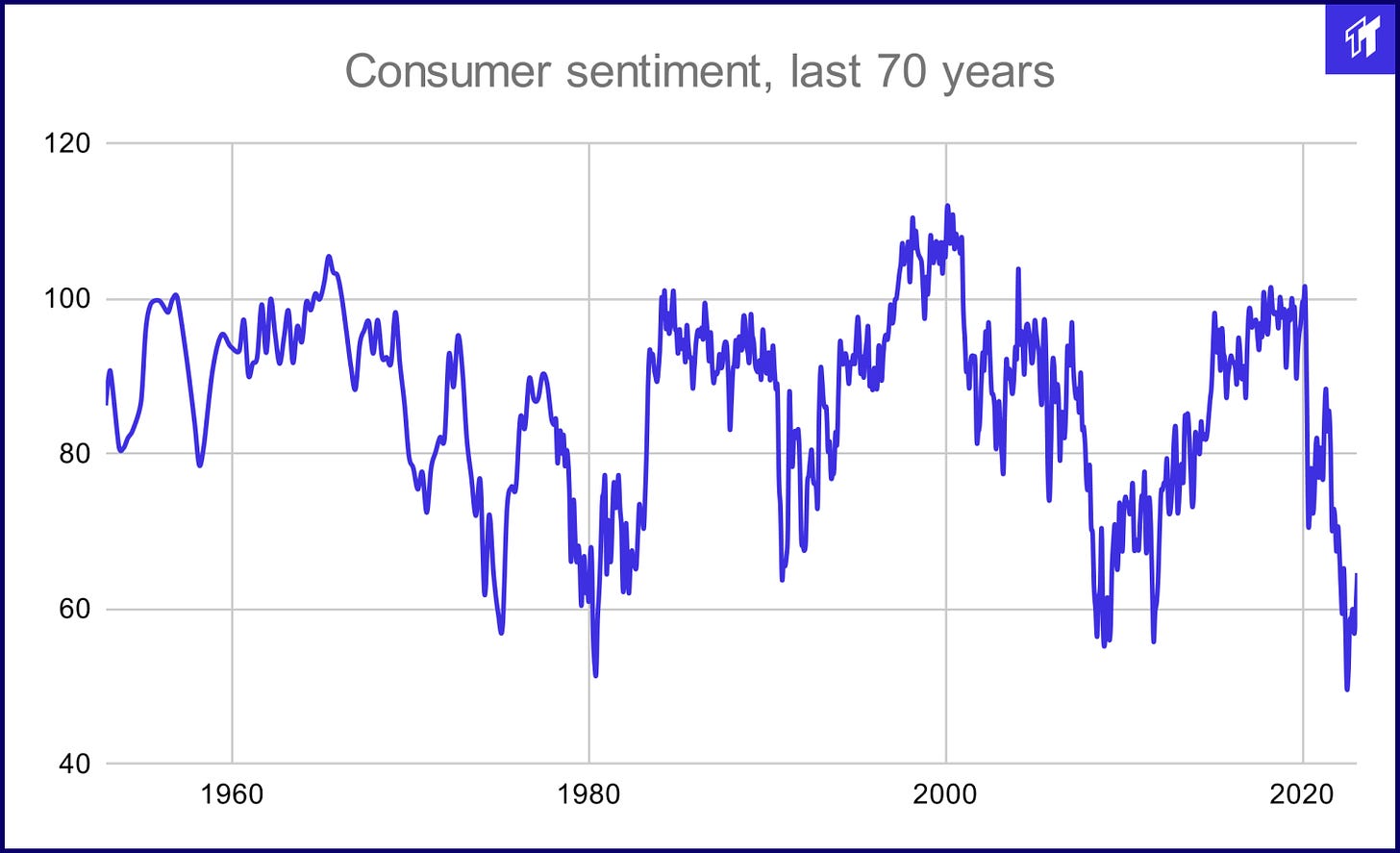

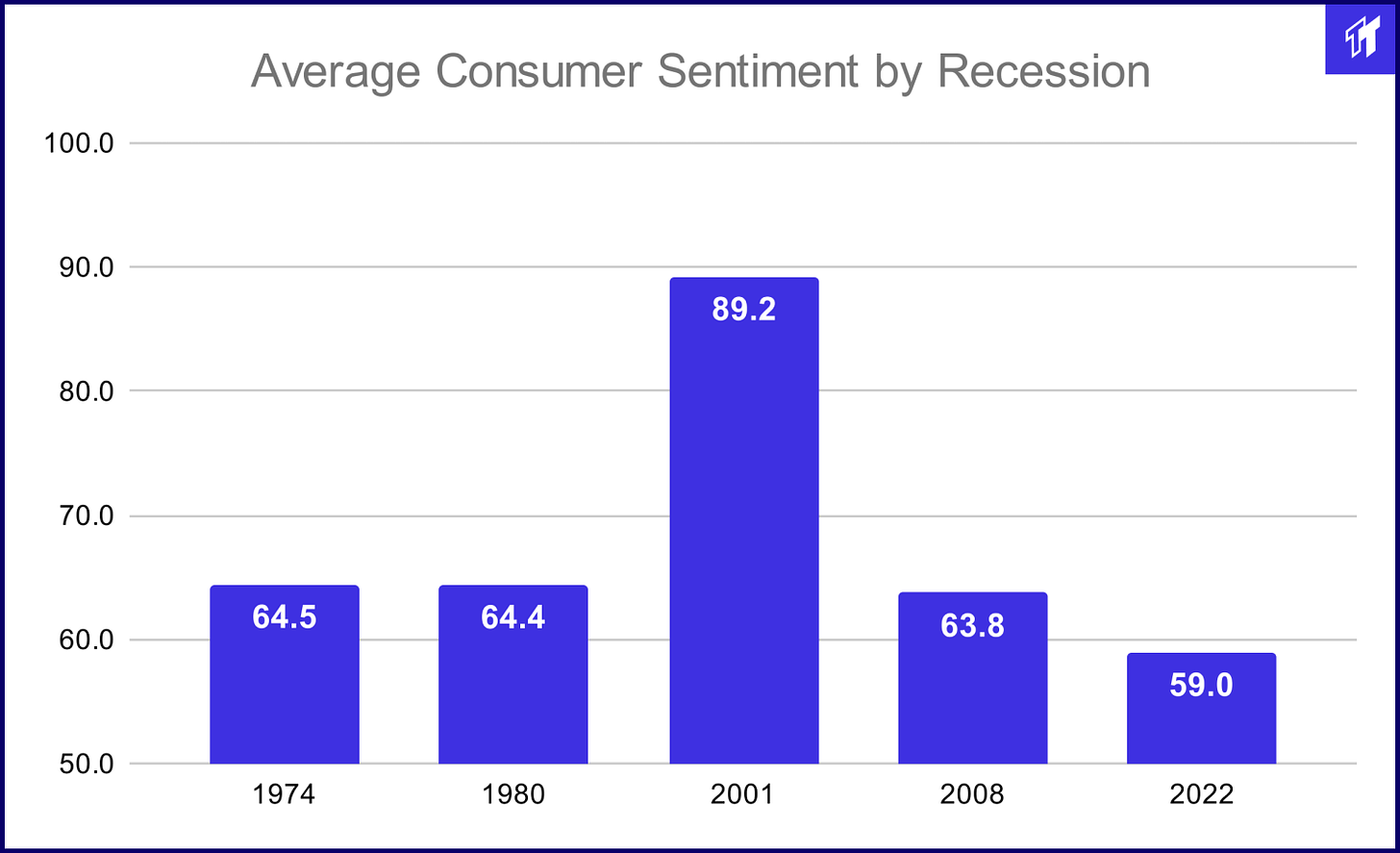

In '22, the Consumer Sentiment Index, which began in 1952, hit a record low:

Consumer sentiment was nearly ~10% below *prior recessions* in 2022

Summary - five reasons there is going to be a recession:

[1] 40+ year inflation highs; [2] Rising interest rates w/ more hikes ahead; [3] Wage growth < inflation; [4] Thin consumer savings; [5] Rock-bottom consumer sentiment...

How 2022 compares to past recessions by key indicator:

Thanks for reading! For more on macro, my favorite follow is @BobEUnlimited

Follow me & @thursdaythreads for more posts every week

& thanks to Tyler Galpin and this week's co-author, Ben Kany !