Originally published on Twitter and Linkedin on 01/12/2023

Valuations soared to mind-boggling marks the past two years. It’s hard to find a tech company that’s *not* overvalued in the private market.

Everyone knows a reset is coming – but what will be the new normal?

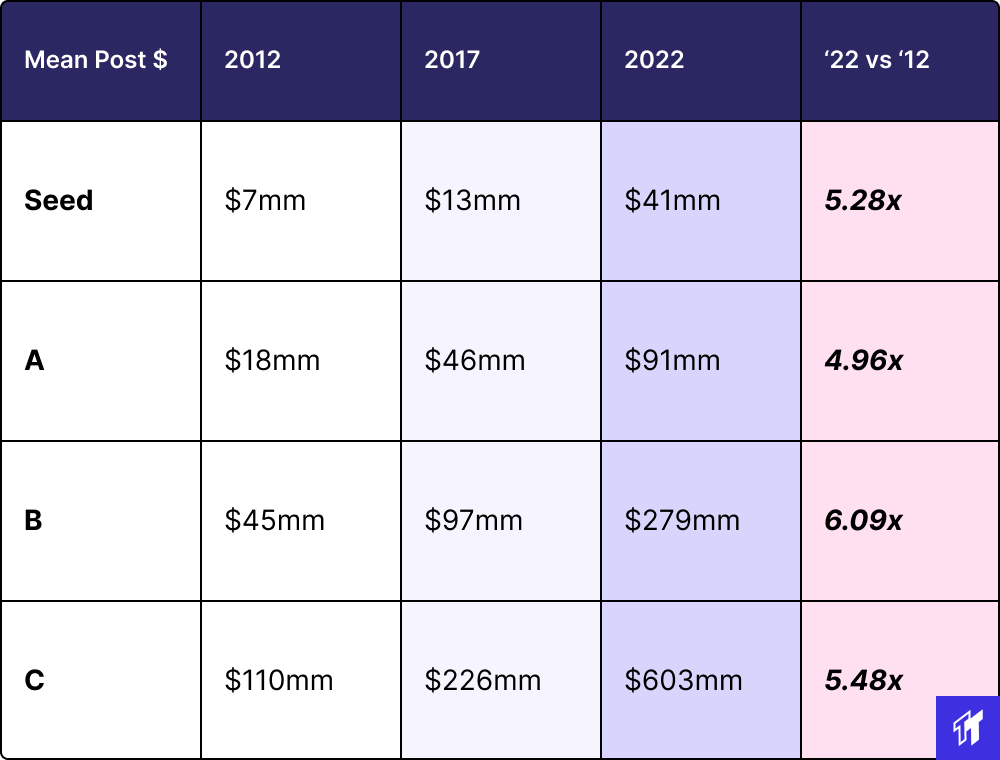

Over the past decade, valuations are up ~5x (!!) across stages.

Average post-money valuations, by stage, in 2012, 2017, and 2022:

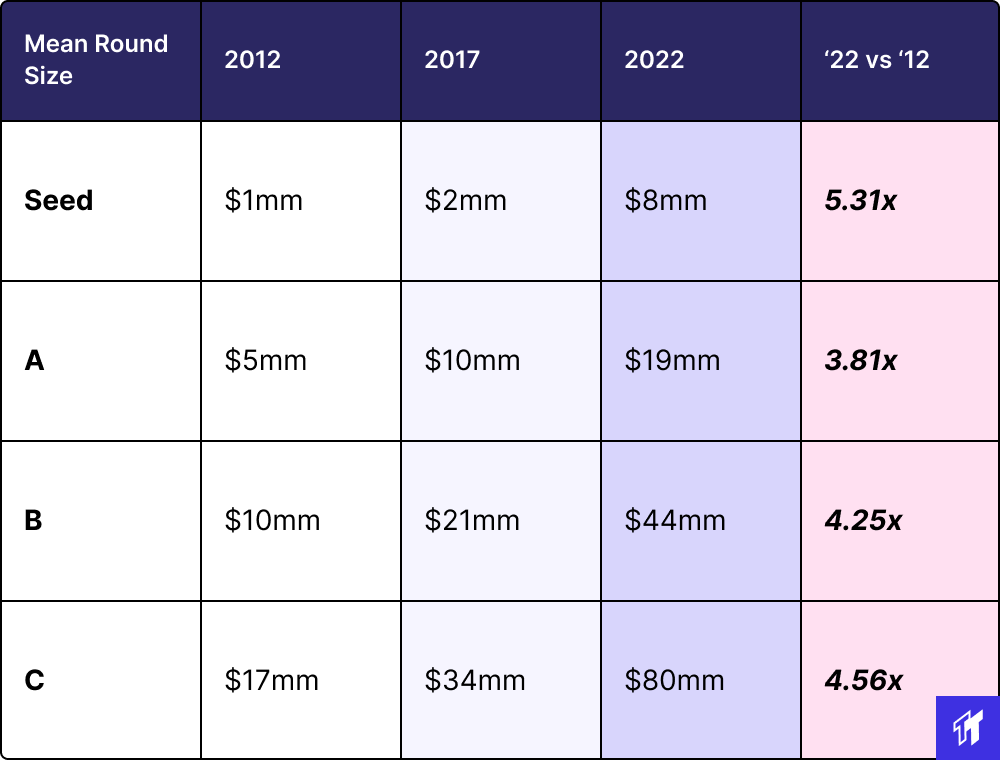

Round size has expanded in lockstep at a pace of 4x+ over the same period.

Average round size, by stage, in 2012, 2017, and 2022:

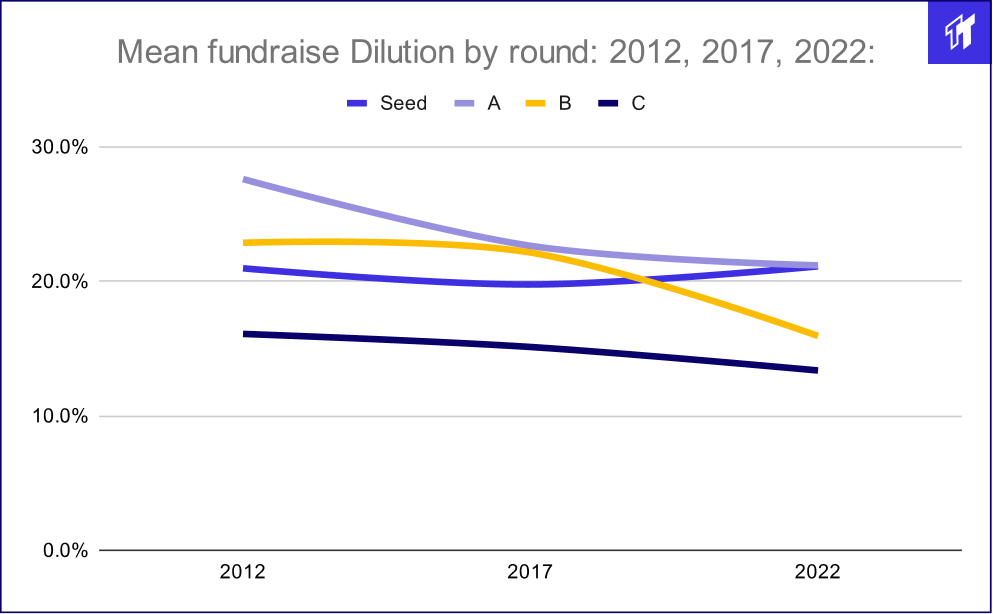

While valuations ballooned, investor ownership compressed. It feels like there's a floor at ~20% Seed/A and ~15% B/C.

Average dilution, by stage, in 2012, 2017, and 2022:

These charts tell us it has become:

more expensive to invest (valuation)

more expensive to build (round size)

ownership thresholds still exist (dilution)

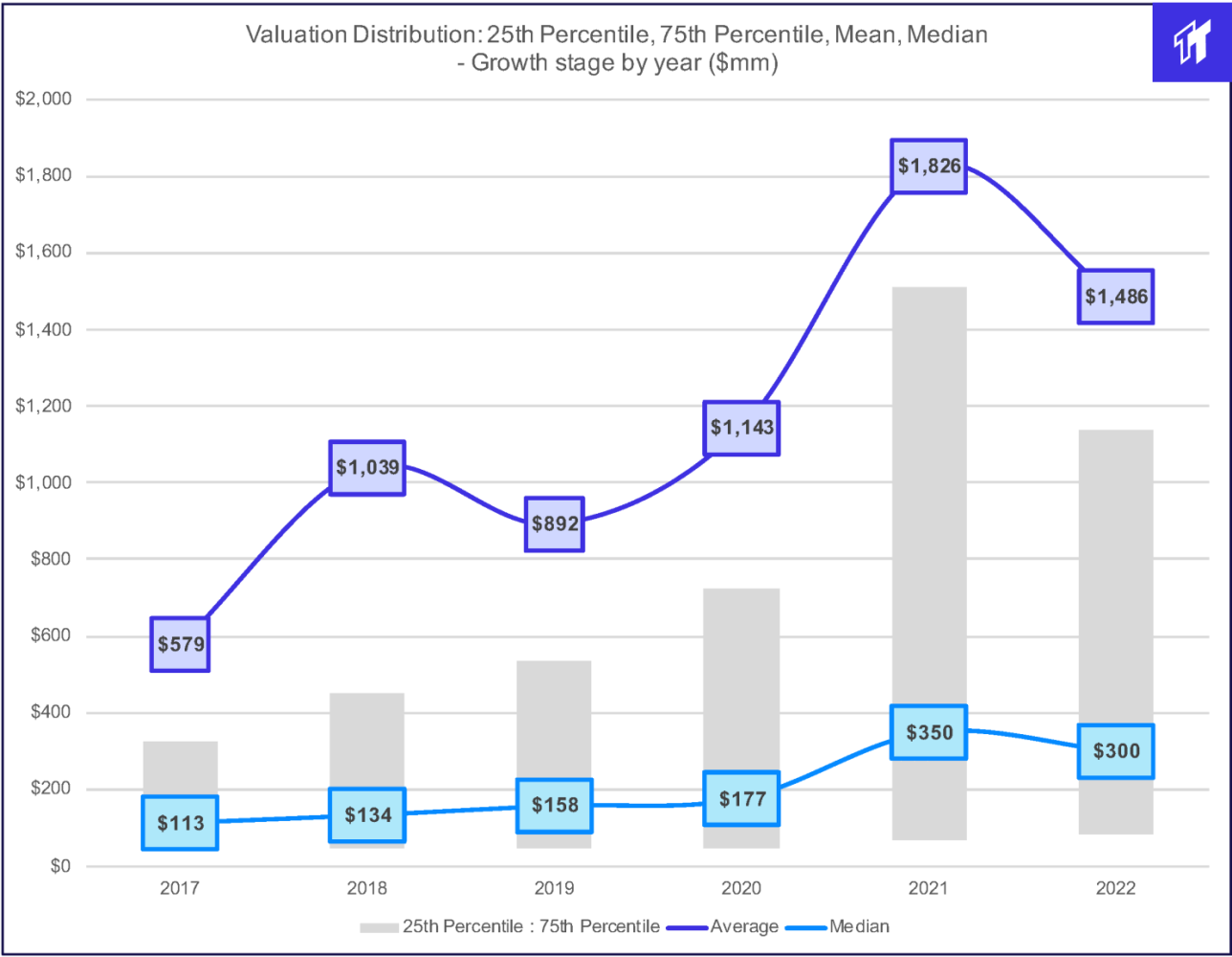

So what’s the deal landing zone go-forward? It depends on the distribution.

The above is *mean* data, which is heavily driven by outliers, well above medians, and higher than even the 75th percentile of deals.

This is due to the high price tags on great assets [95th percentile+]

Here’s a look at how ‘paying up for the best’ skews growth-stage valuations.

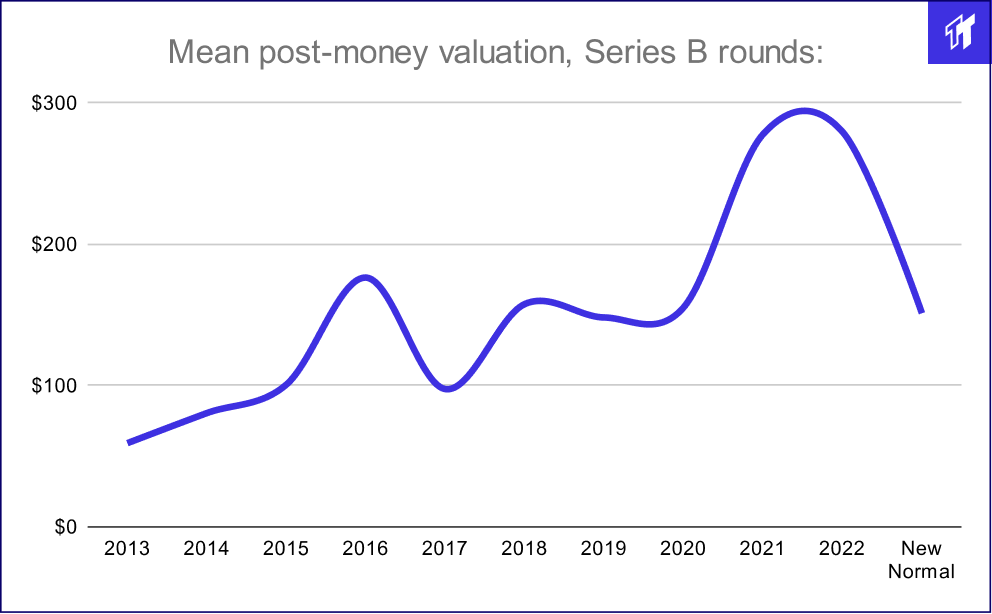

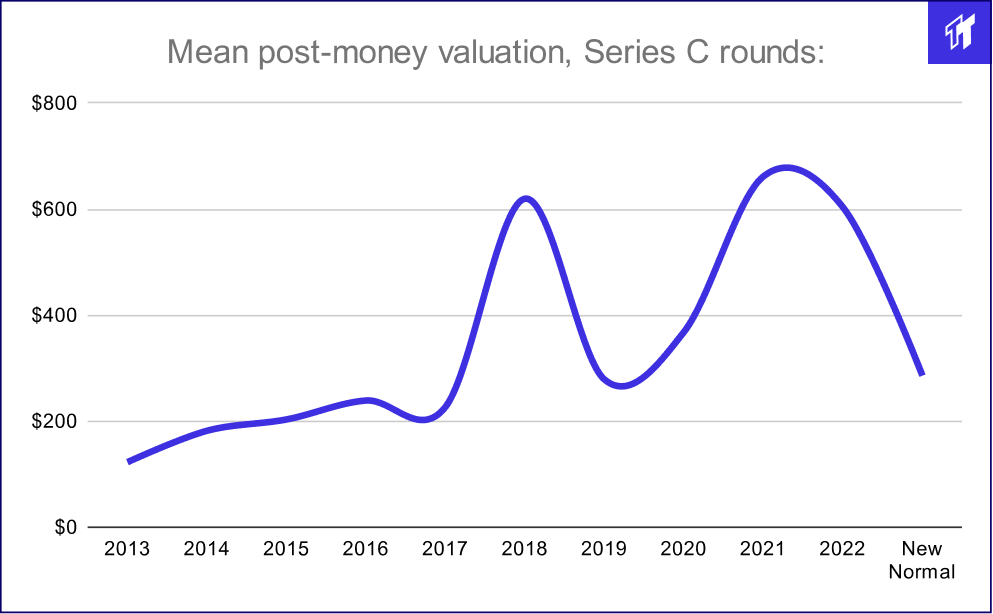

The *mean* valuation was ~5x the median in 2022, and as high as 8x in 2018:

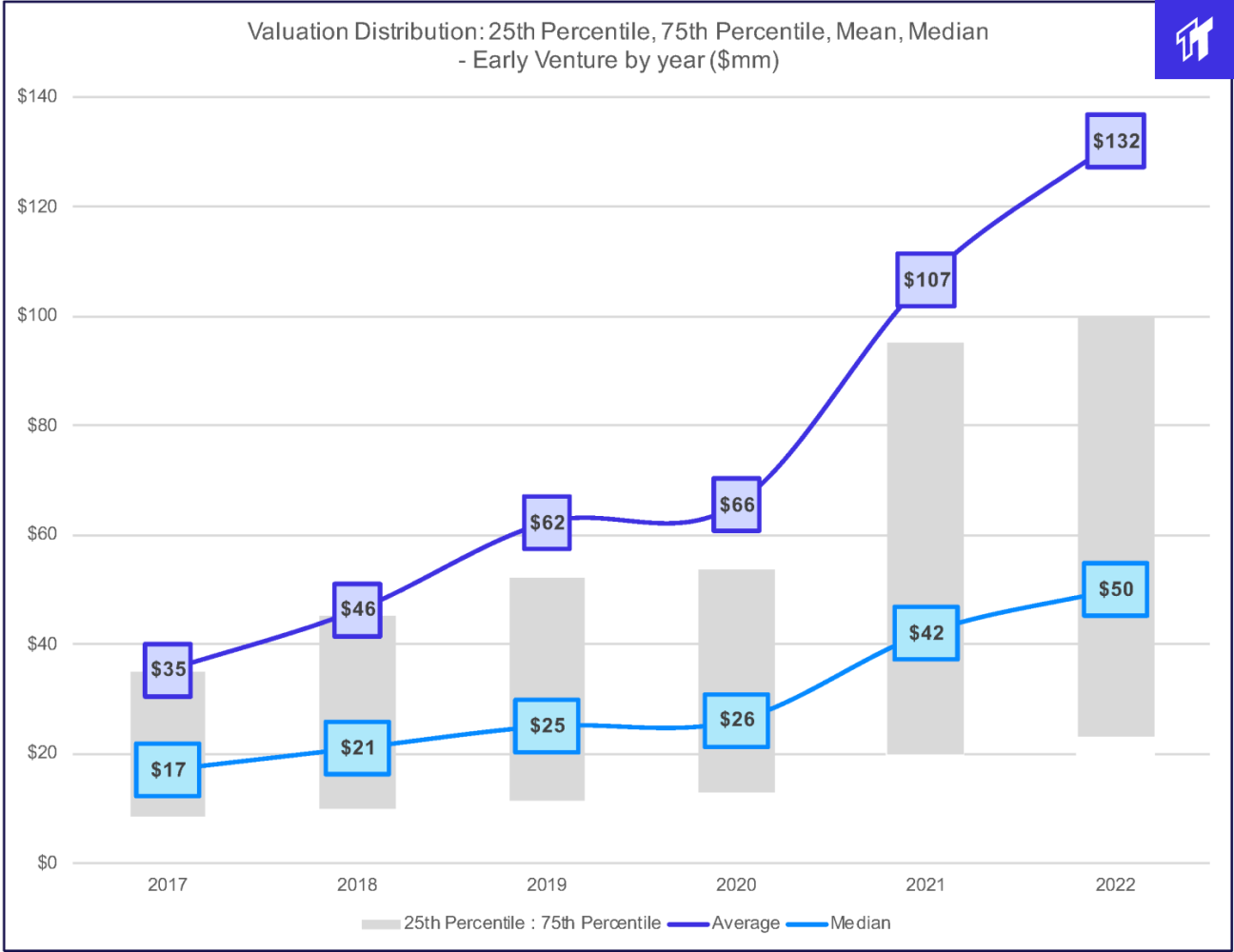

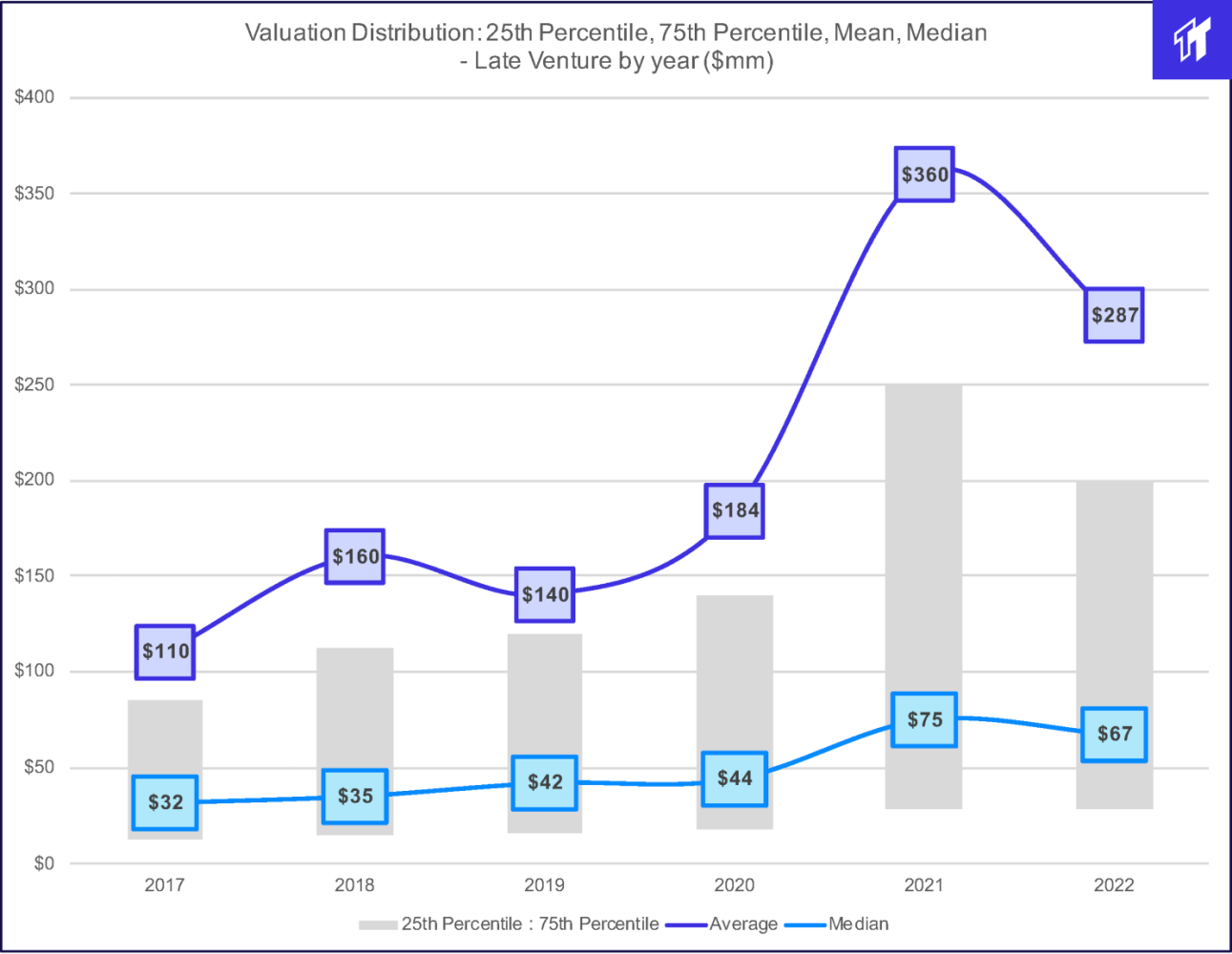

Here’s what that distribution looks like in early-stage and late-stage venture.

Averages again outpace medians & the 75th percentile:

Because 75th+ percentile assets are the only ones that will survive, let alone raise clean rounds in the coming years, I chose to focus on mean data in this thread.

I believe the new normal rhymes most with 2017, with two changes:

Rounds are 20-50% larger: cost to build is up, dry powder, larger funds & institutions

Dilution oscillates from 22% (earlier) to 18% (later) -- firms get disciplined on ownership

Here’s what that means for valuations…

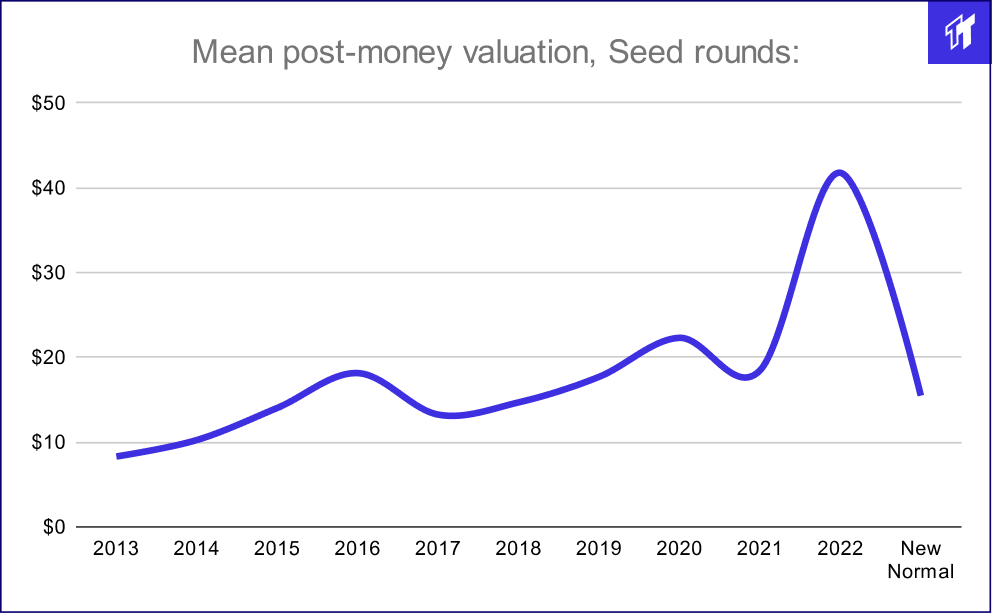

Seed valuations drop 60%+ to a mean of ~$15mm. Round sizes fall to $3.5mm:

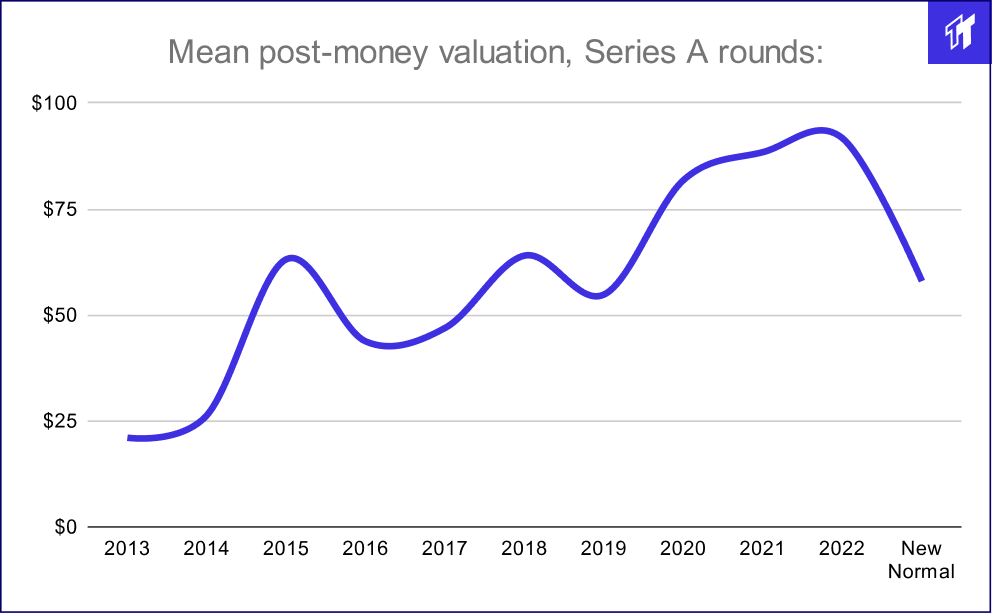

Series A valuations drop 35% to ~$60mm; average round is $13mm:

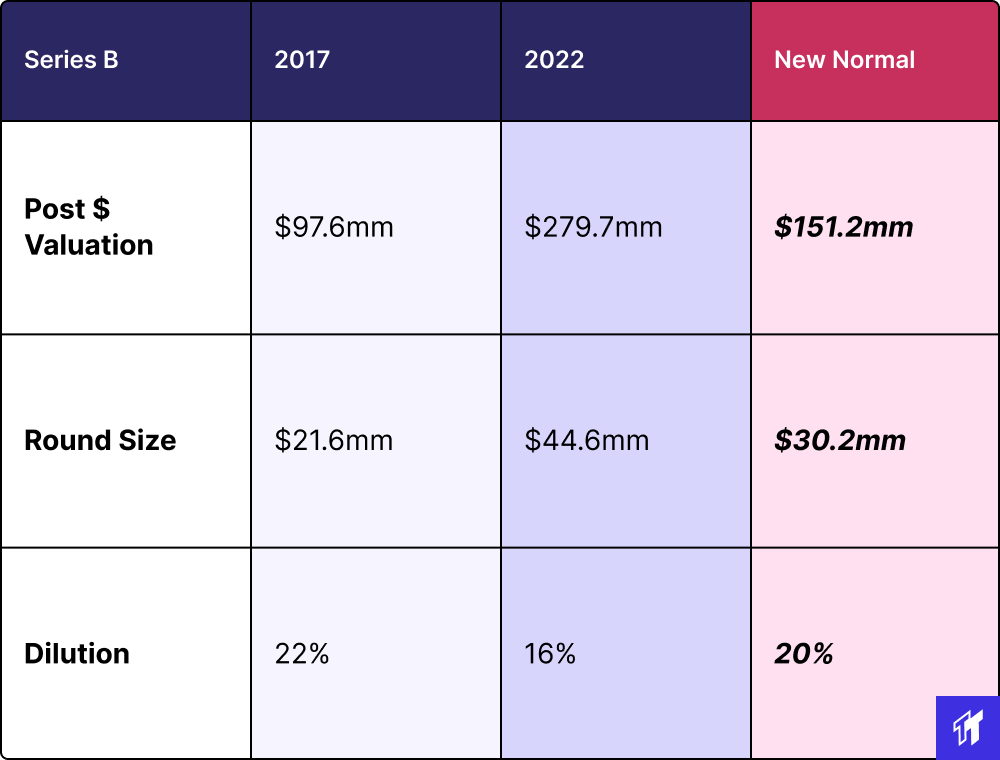

Series B valuations drop 45% to ~$150mm, with right-sized $30mm rounds:

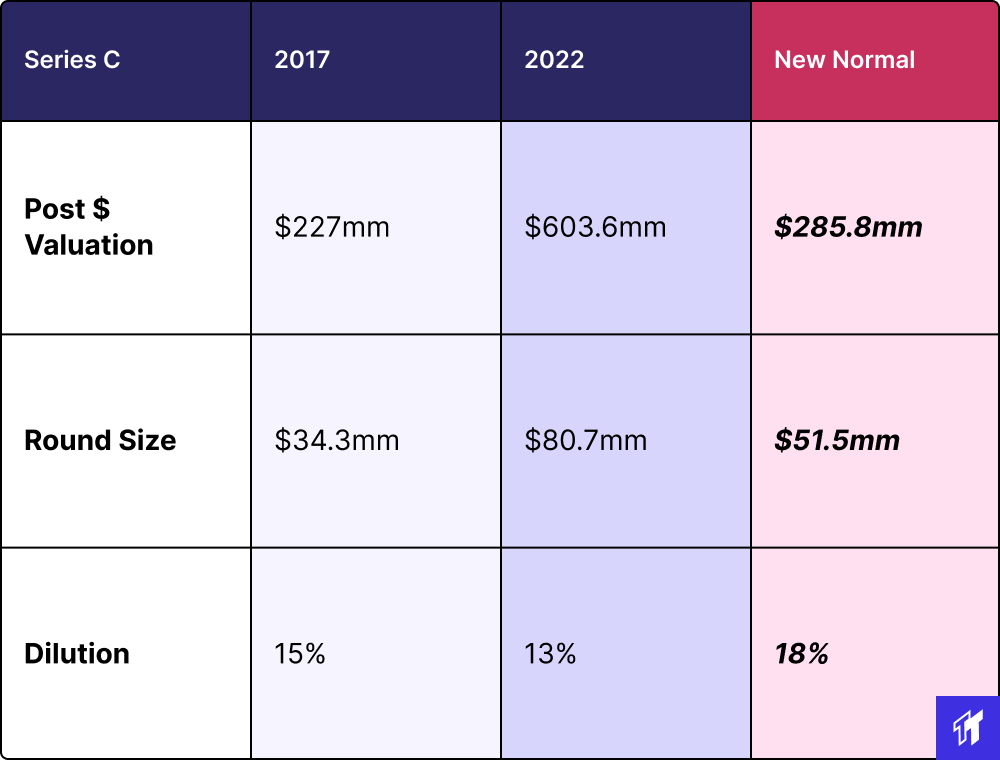

Series C valuations drop 60%+ to $285mm; rounds falls to ~$50mm:

The Valuation Reset:

Seed: $3.5mm on $15.5mm post

Series A: $13mm on $60mm post

Series B: $30mm on $150mm post

Series C: $50mm on $285mm post

Thanks for reading!

Another great resource on valuation and deal trends is this Cooley piece from last month. Specifically the interactive tableau data at the end.

Follow me & @thursdaythreads for more posts, every week.

& thanks to the team here at Bedrock - Tyler Galpin, Sid Vashist, Ben Kany for the lift on this.