Originally published on Twitter and Linkedin on 01/26/2023

VCs are making more $$ despite *worse* returns

How’s that work? Thursday Thread: the VC Industrial Complex…

First, how venture firms make money:

1] Management Fees: typically 2% of funds managed per annum (guaranteed $)

2] Carry: typically 20% of the upside on capital returned (performance-based)

This is the common “2 & 20” model; some funds charge 3 & 30...

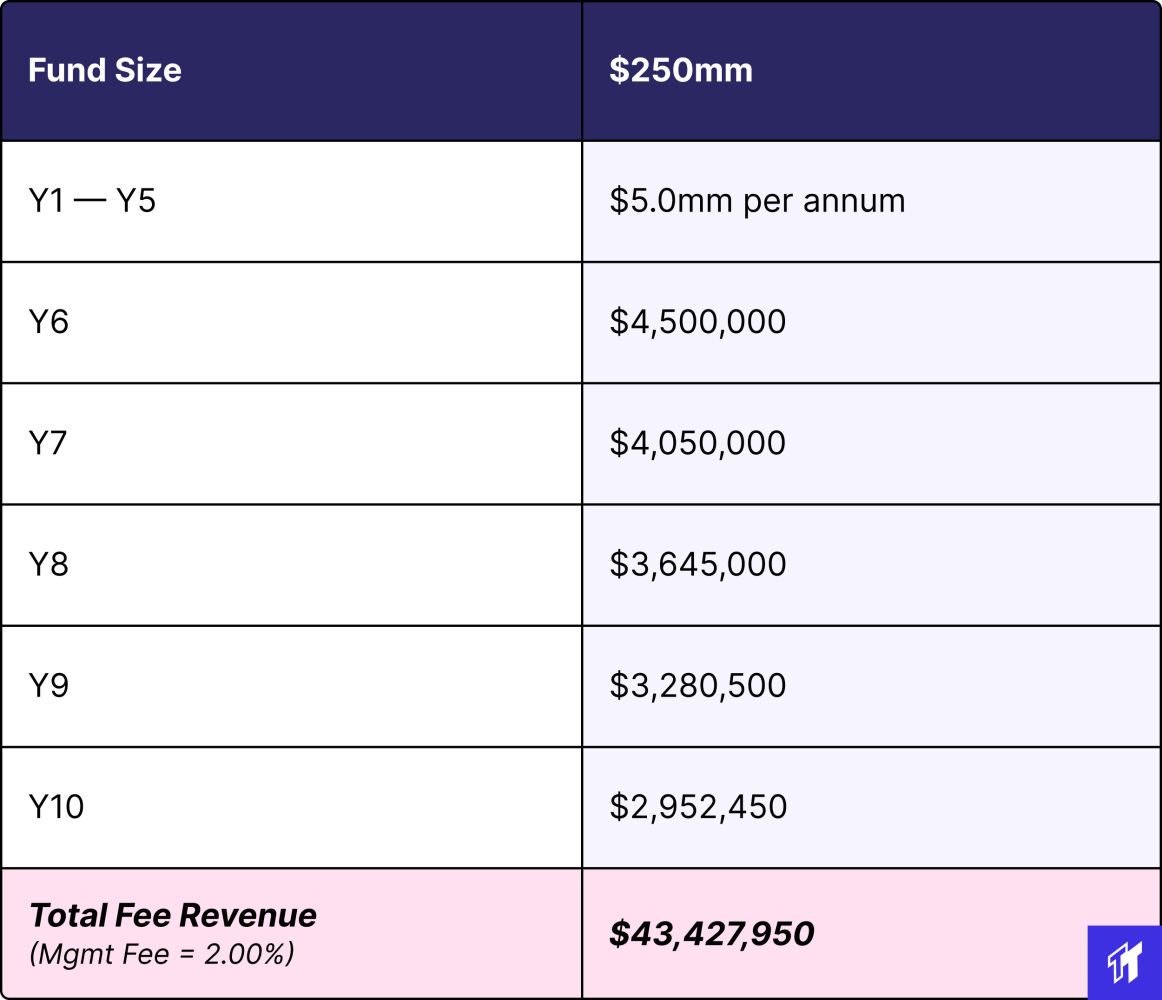

Fees are also subject to ‘step downs’ after the call period (you don’t get to make 2% forever). These typically begin in year 5 at a rate of 10% per annum.

Still, a $250mm fund with 2% fees will generate ~$43mm over ten years:

Because of fees, LPs typically need a 1.2x MoM just to make a 1x net. And this is before accounting for carry. Here’s what a fund must produce to make its LPs a 2x *net* return:

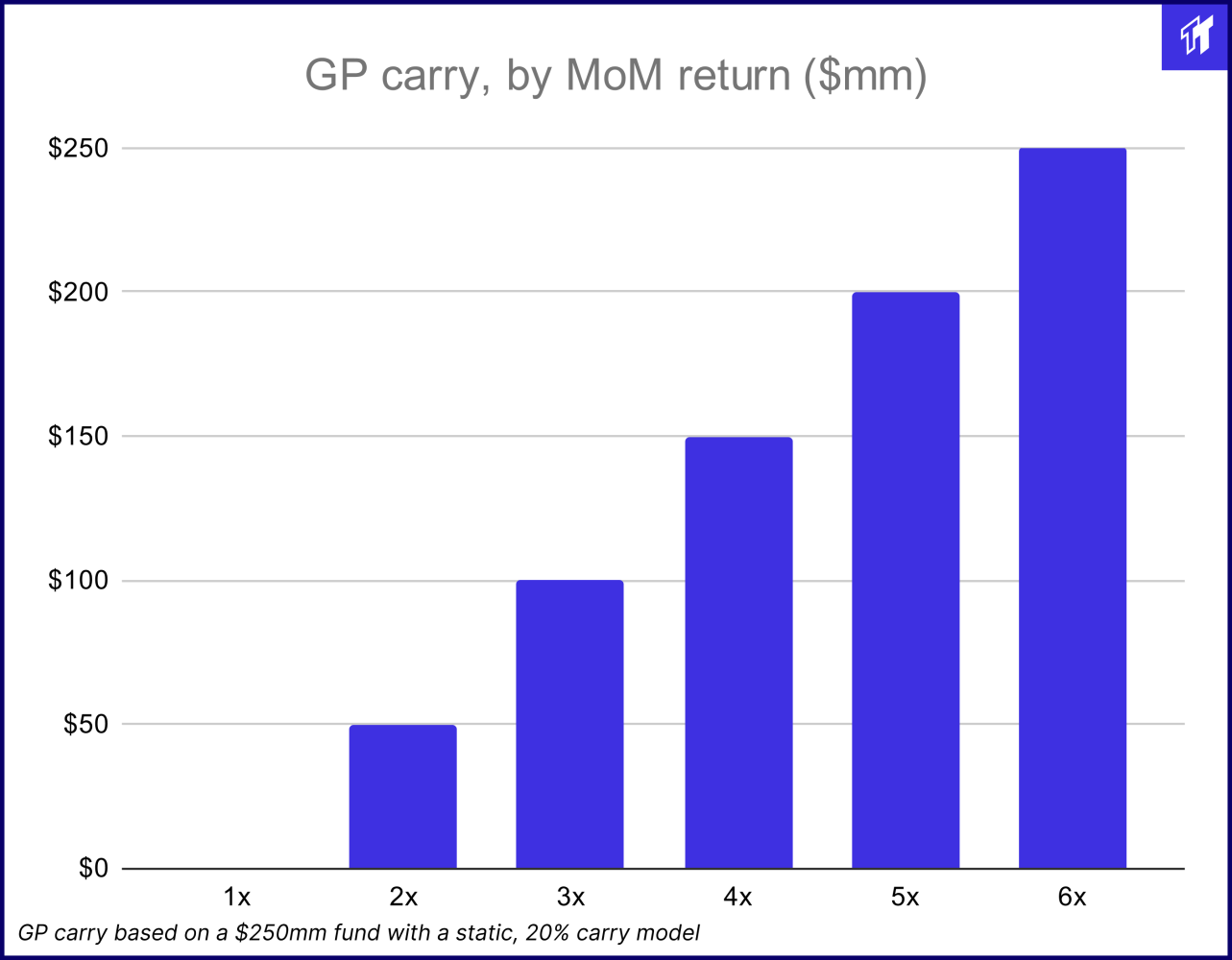

More on carry: an interest in the upside of capital returned. Typically this is 20% with hurdles to unlock more carry w/ more returns. If a $250mm fund returns a 3x MoM, its GP walks away with $100mm:

Pretty strong performance incentive! Accordingly, VCs were historically small shops that swung for the fences to maximize returns (and carry).

But over the last decade, as the asset class matured, incentives changed... Firms recognized an opportunity to instead pursue *fees*

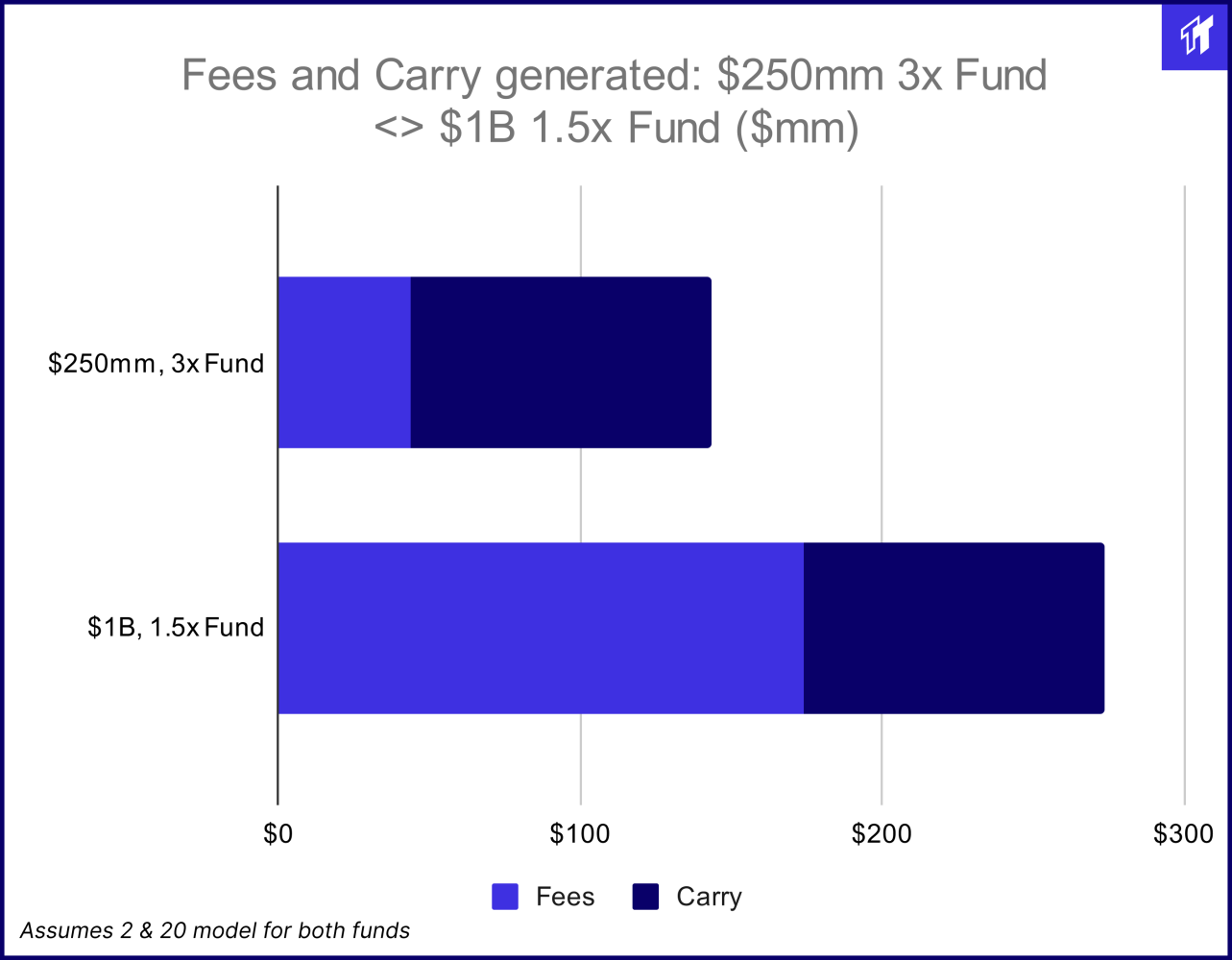

It’s a bit of a prisoner’s dilemma: GPs make more $ scaling AUM, despite *worse* returns. Imagine a GP can either:

[A] 3x a $250mm fund

[B] 1.5x a $1B fund

The smaller, 3x fund is obviously more attractive for an LP. But the GP nets nearly twice as much on the large, fee-maximizing fund:

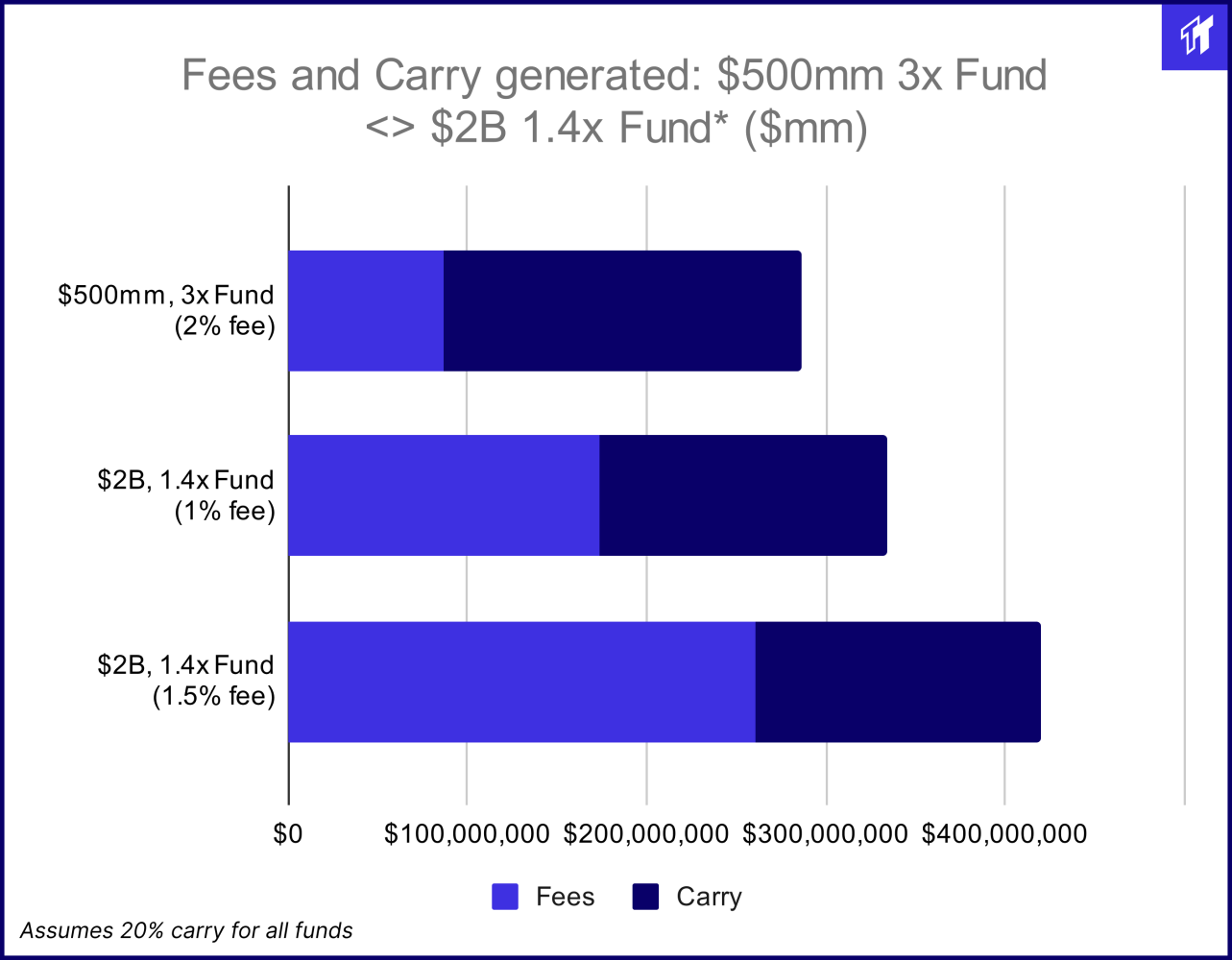

A less dramatic contrast would be:

[A] 3x a $500mm Fund vs.

[B] 1.4x a $2B Fund (with lower fees)

Still, the larger fund nets more to the GP, even at a 50% fee discount:

This dilemma is reinforced by the fact that fees *dramatically* reduce risk to the GP. Fees are effectively guaranteed money! GPs can make more and risk less despite returning less.

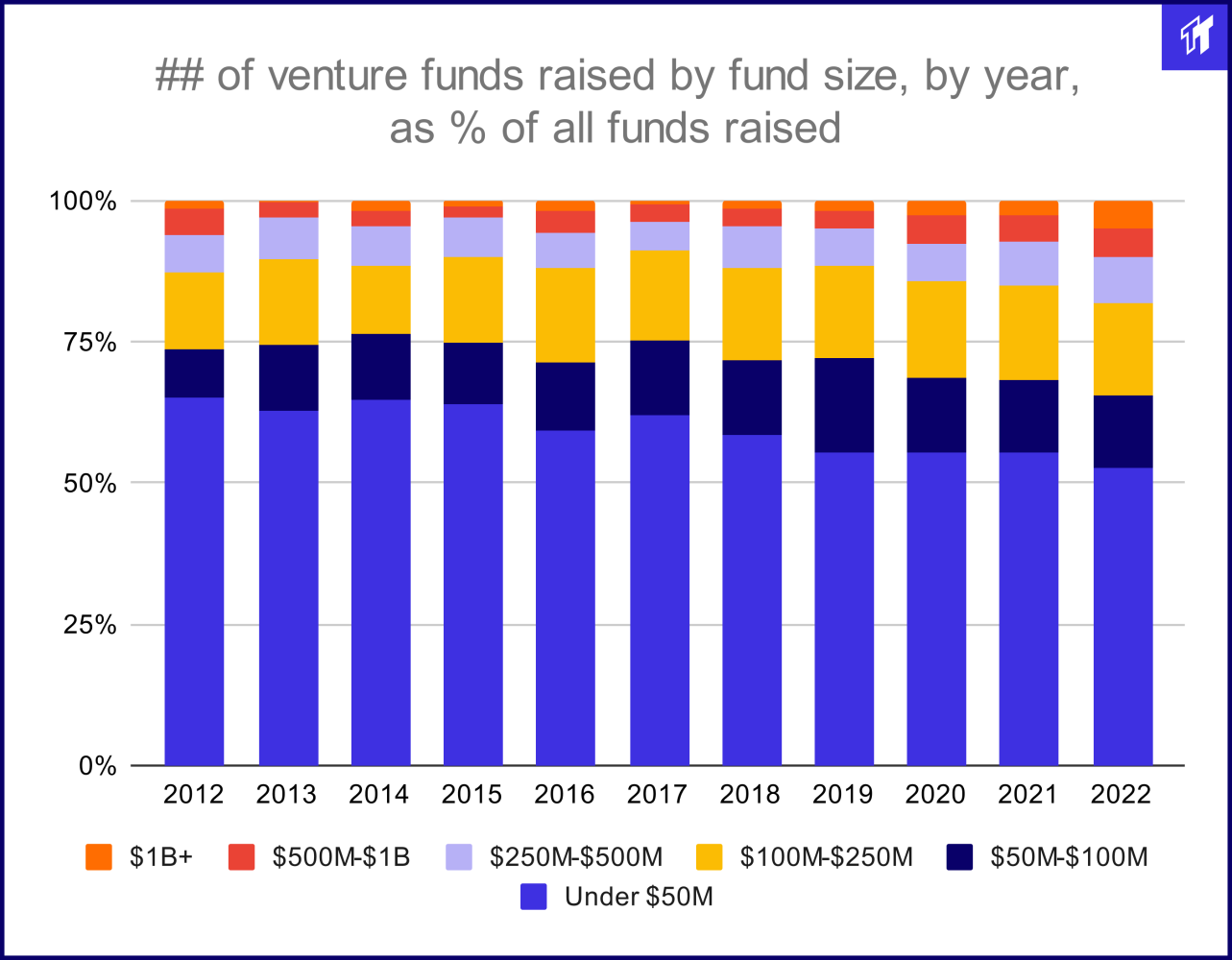

These incentives were encapsulated by the race to scale in recent years. Below is a look at the ## of venture funds raised, per annum, by fund size.

From 2012-2018, $500mm+ firms were ~3% of new funds raised

In 2022, that figure was up 3x to nearly 10%

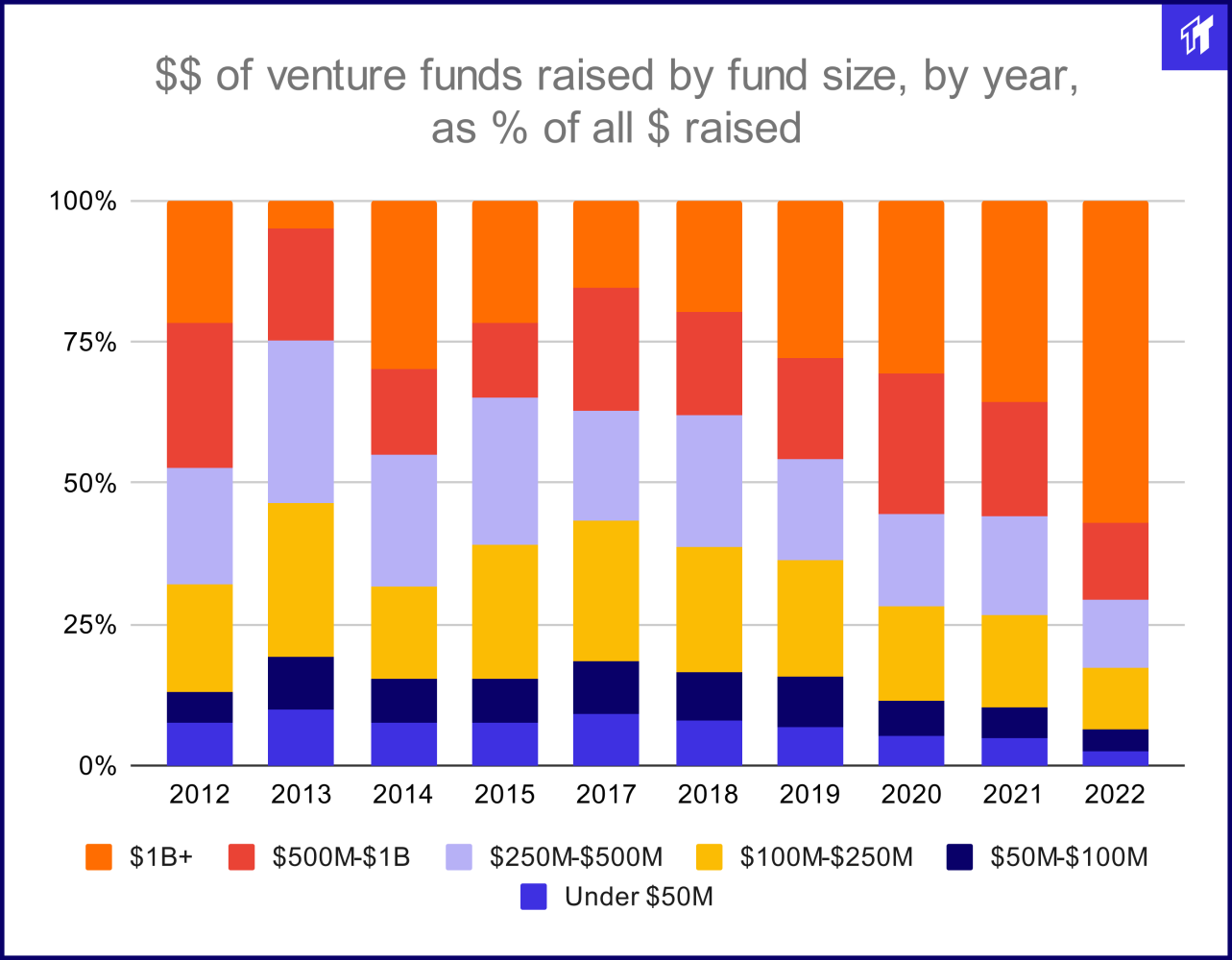

On a dollar basis, the trend is even more dramatic. From 2012-2018, $1B+ funds managed 20% of new capital raised

Last year that figure was over 55% (!!)

This shift underscores the ‘VC Industrial Complex’

Large (often multiple) funds; large (often multiple) teams; an emphasis on capital deployment; 'streamlined' (outsourced) DD...

Many VCs are becoming an apparatus for AUM scale & fee harvesting.

In the defense of these mega-funds:

i] Some LPs have IRR hurdles or PIKs

ii] Companies are private longer; an ‘index’ is a valuable, hard-to-build product

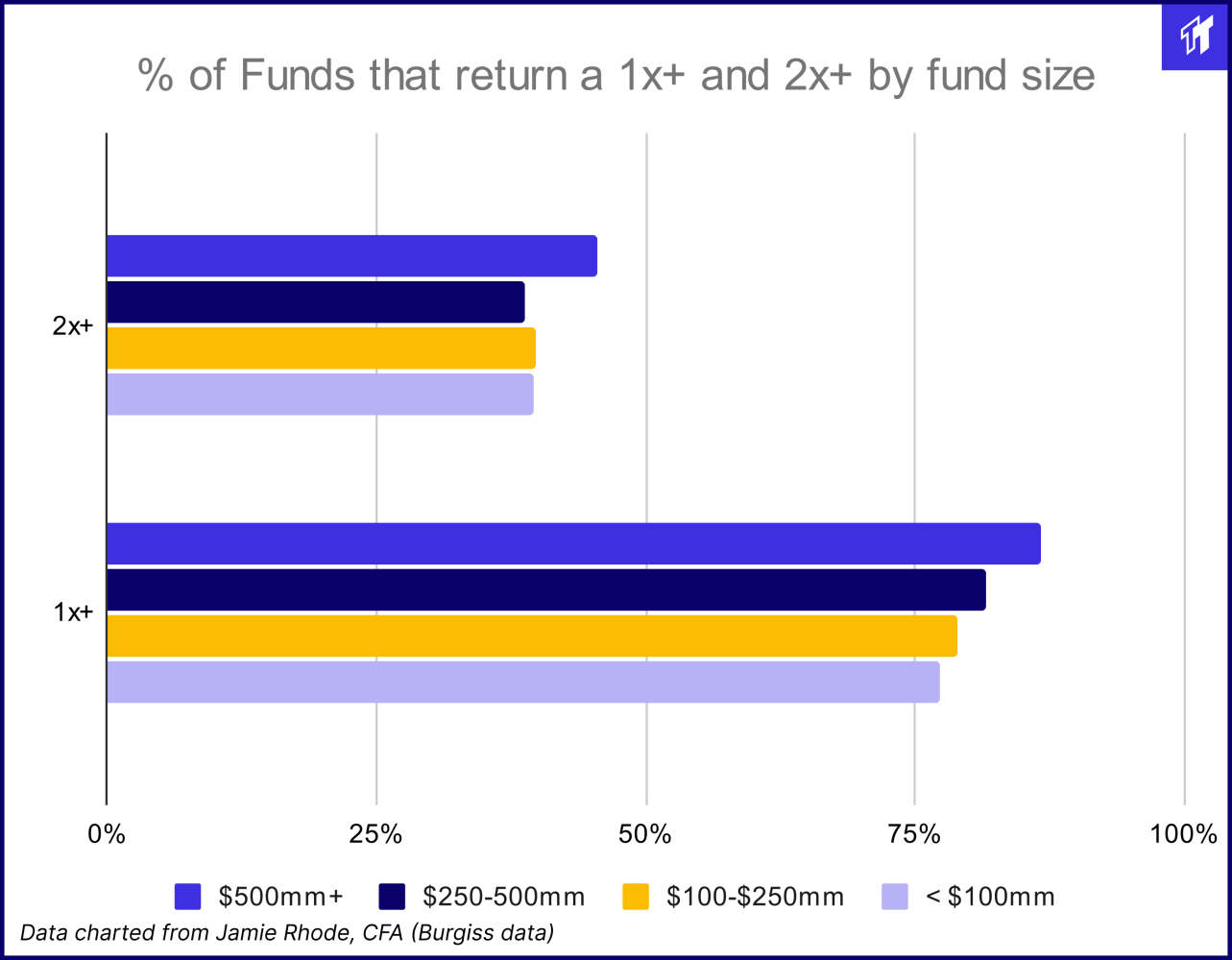

iii] Despite overall lower returns, big funds more consistently return 1x+ or 2x+

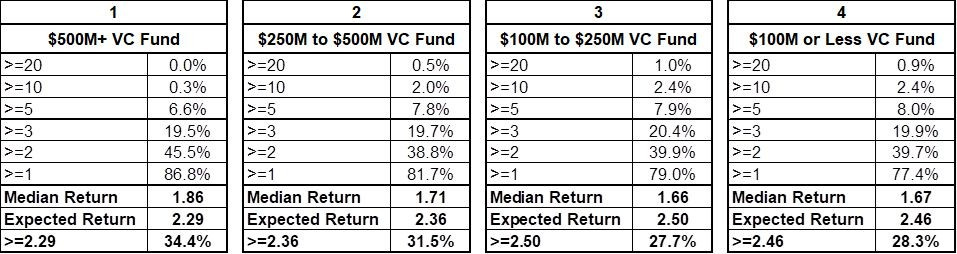

Below is a complete look at fund performance by fund size. The three smaller firm sizes all outperform the largest ($500mm+) on an expected basis. [Data from Jamie Rhode, CFA]

I believe large funds will continue to thrive: they provide a differentiated, valuable product to LPs & entrepreneurs. However, we will see a visceral return to right-sized, true VC at Seed/A/B (and some C):

< $1B vc funds focused on strong MoM returns.