I don’t think folks appreciate just how saturated tech is right now. One barometer: the ludicrous of CB Insight market maps. Most recently:

“96 AI companies focused on radiology”

“200 automating compliance for financial institutions”

“100 Asia-Pacific insurtechs”

The volume of logos, addressing relatively niche markets, is astounding. How did we end up with 200 compliance automation tools — just for institutional finance?

In the past three years, there have been ~4,000 Series A/B deals per annum.

That’s up +60% compared to the seven years prior. Moreover, many of these companies compete with each other.

Venture dollars pour into a small set of categories. Imagine you’re one of these categories (let’s pick on sales-enablement software).

In 2013, you had maybe 2-3 competitors. Most of the work was building & evangelizing product.

Today that same business is facing upwards of 6+ funded, competing peers.

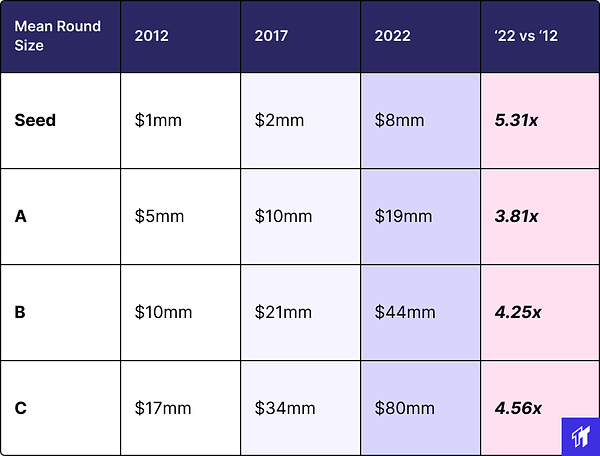

And these competitors haven’t just multiplied — they’ve raised dramatically more $$$. Round sizes are up +4x over the past decade. More on that here:

So: while you might have 2x the competition, you’re actually facing an 8x+ change in competitive spending. This hits the cost structure and apparatus of your entire business: talent, CAC, retention, and more.

Some napkin math on what’s happened in respective categories:

2013: two companies raising ~$5mm Series A → $3.3mm annual category spend

2023: five companies raising ~$18mm Series A → $30mm annual category spend

This has an obvious impact on an entrepreneur’s ability to grow efficiently.

Another, less-obvious implication is for investors: time-to-consensus.

In less saturated times, categories took many years to achieve consensus. It wasn’t that long ago investors were questioning the TAM & durability of Stripe, Slack, and Datadog.

This debate enabled believers to invest at better prices, in more efficient assets, and build greater exposure prior to being proven ‘right’ – driving outsized returns.

Today, however, emerging tech categories become riddled with fast followers in mere months. This erodes returns for investors and entrepreneurs alike.

These software categories are big — but they’ve been stretched to a point of saturation. There can only be so many compliance companies! And there’s only one OpenAI (:

To entrepreneurs: I acknowledge you now have to drive efficiency in a market that has had ROIC historically impaired – especially in software.

The good news: companies raised big $$ in recent years, have time to get fit, and have many M&A prospects (see your relevant CB Insights market map).

Thanks for reading! Subscribe for more weekly posts on tech & investing:

The times they are a-changin'...